A simple playbook for VC Marketing foundations

When I started my career, marketing was almost a dirty word in venture capital. Many top investors prided themselves on flying under the radar - some legendary firms barely even had websites. The unspoken assumption was that VC was a behind-closed-doors industry, nurtured by exclusive networks and personal introduction. Who needed “marketing” when you had relationships? Fast forward today, the landscape of asset management marketing looks entirely different, with most firms doing some sort of hygiene marketing. And because positioning matters for any company, if you’re not shaping your narrative, someone else will shape it for you.

In a recent 2-hour masterclass I ran for the EUVC community, I delved deeply into how the VC marketing game has shifted and what modern funds need to do about it. I thought I'd share some of the insights on my blog for the ones who would be tempted to scan through the main concepts. You can access the full video here. I share how the VC marketing game has evolved and a few tips on key marketing items for fund managers getting started.

I regularly chat with fund managers looking to ramp up their marketing: too often, they spent years spending marketing money on distribution and overlooked strategy, because marketing was seen as a distribution engine not to acquire new deals. But modern venture firms have caught up, and have build brand equity, doing marketing in a genuine and systematic way - raising the level playing field for the entire ecosystem.

Before I dive into the gist of it, I want to introduce two key marketing concepts that I find are essential to fund management and are core to how I approach the discipline.

- Editor-in-chief. Marketing in a company is more of an editorial role than distribution role. In investment, the product is a combinaison of the investment team and the investment thesis, but marketing role is to filter what makes more sense to highlight to deliver the product into the right hands.

- Momentum-driven-marketing. One of the most unique features of asset management businesses is that the company will survive at least 10 years. This means marketing can't be momentum driven (by deals, the market) and one needs to withstand this long timeline.

Context: the changing landscape of VC Marketing

The venture capital landscape has changed so dramatically that simply showing up with a cheque is no longer a guaranteed ticket to the best deals. Founders now have their pick of investors and expect genuine engagement on everything from diversity and sustainability to geopolitics and sector insights. Meanwhile, marketing roles have been elevated far beyond junior PR positions: leading firms are assembling entire teams dedicated to shaping their narrative, building media relationships, and driving real value for portfolio companies.

Add to that a tangle of cross-border regulations around “pre-marketing” and a steady blurring of lines between PE and VE, and you have an environment where pure fund size just won’t cut it.

Even the AUM game doesn't work anymore for positioning a fund, as many large funds struggle to deploy capital. As a result, marketing now sits at the core of a fund’s strategy - strengthening deal flow, supporting founders, and building trust with LPs. This environment has raised the bar on how funds position themselves. Where a decent website and a few conferences appearances used to suffice, now they need a robust content strategy, strong media relationships, and carefully crafted LP communications.

Building the marketing function: process before tools

Many firms start by picking a couple of marketing channels, perhaps hiring a PR agency for a big fund announcement, sponsoring a high-profile conference or launching a podcast. That might help with short-term visibility, but it often fails to build the deeper credibility that leads to consistent deal flow or lasting LP confidence.

I’ve actually found it most effective to start with processes rather than tools. At the core of any marketing process is clarity on who you’re trying to engage and why. If you can nail that, the rest becomes considerably simpler. Distribution comes after you can build on top of replicable systems.

For instance, before you spend money on a flashy CRM or an expensive media retainer, ensure everyone on the team understands:

- Your investment thesis and how it translates into distinct messaging.

- The specific founders or segments you want to attract, and how you’ll reach them.

- The type of LPs you want to partner with, recognising their constraints and interests.

- The firm’s core values and “voice,” which should be consistent in all communications.

Another example is content creation using AI tools. Before opening your Substack newsletter, you should have the following resources for a state-of-art prompt:

- A narrative document (see below), which gives comprehensive context on your thesis and unique concepts you want to highlight.

- A process to treat conversation and convert any interested party into a qualify lead, which you can invite to events (thematic dinners, for example).

- A series of replicable content format - you actually want any created content to be part of a series, which you will consistently deliver (investment in, interviews, market views...)

Once the foundation is set, then you can decide if you truly need a premium email automation platform, or whether a simple spreadsheet plus a well-structured narrative is enough.

A good rule of thumb: every marketing decision should answer the question, “Does this support the firm’s core strategy?” That question alone can stop people from spamming their networks with generic content or participating to conferences that don’t align with your focus.

1) Crafting and managing your narrative

A clear, compelling narrative is the backbone of all successful marketing. It’s how you communicate why you invest in certain companies or sectors, how you work with founders, and how you see the future. If you can articulate that succinctly, people are more likely to remember and repeat it.

The best way to start is by gathering what you already have. You're already creating tons of content without marketers and you should never delegate the narrative work to a marketer. It is your process. Investment memos, internal briefs on emerging sectors, and the talking points you find yourself repeating to founders or LPs - these can all feed into your narrative.

A narrative essentially consists of:

- The context of the market you’re focused on and why it’s at an inflection point.

- Your vision for how technology and market shifts will shape that space over time.

- The specific investment principles guiding your decisions.

- Evidence of success, including portfolio case studies or quantifiable results.

This narrative should live in a written document that everyone in your firm can refer to. It’s also wise to keep it “living” rather than set in stone: as you learn from deals, portfolio performance, or sector shifts, you can update the narrative so it’s always current. It's your knowledge base.

Finally, treat your narrative like an editorial product. Building on my concept of editor-in-house, don’t let just anyone in your firm publish anything on the company's behalf. A strong editorial stance means you’re clear on what your firm will (and won’t) say publicly. When you’ve nailed that, PR agencies and conference organisers will also find it easier to service you. You'll also find that anyone in the investment team can build long term marketing assets for the franchise brand, not simply growing the muscle of their own personal brand.

2) A content flywheel independent from your investment pace

One common pitfall is to let your content strategy revolve solely around new deals (and overlooking the marketing momentum concept) announcements of investments, exits, or fund closes. That can lead to long stretches of silence when you’re not closing a round. Instead, aim for a content “flywheel” that runs regardless of your investment pace.

Start by pulling insights from everyday processes. Each time you assess a sector or create an investment memo, there’s likely a nugget of valuable analysis buried in there. Transforming that into shareable thought leadership can help you build credibility. The extra benefit (which I how I typically explain content): the firm’s partners, analysts, or associates are forced to refine their thinking in the process (See my article: Not Writing: A cover up for incomplete thinking)

Here are a few formats that work well:

- Short articles highlighting “lessons learned” from a particular sector.

- Opinion pieces reacting to timely news in your focus area.

- Interviews or case studies featuring founders in your portfolio.

- Brief thematic analyses based on market data or your own pipeline insights.

Crucially, publish regularly enough that people come to expect your commentary. If you’re concerned about the workload, lean on the editorial mindset. It only takes one or two compelling pieces per month to maintain visibility, especially if they’re genuine and well-reasoned. Over time, these smaller pieces add up to a coherent body of work that positions you on the map before your next official announcement.

This approach also tends to make your PR efforts more effective, because you’re consistently building relationships with the wider tech ecosystem. Consistency fosters trust: people start to see you as a go-to source in your space. Along the way, you will be able to identify more clearly what is immediately useful to feed back your product (knowledge loop for the investment team) or increases long term brand equity (franchise building).

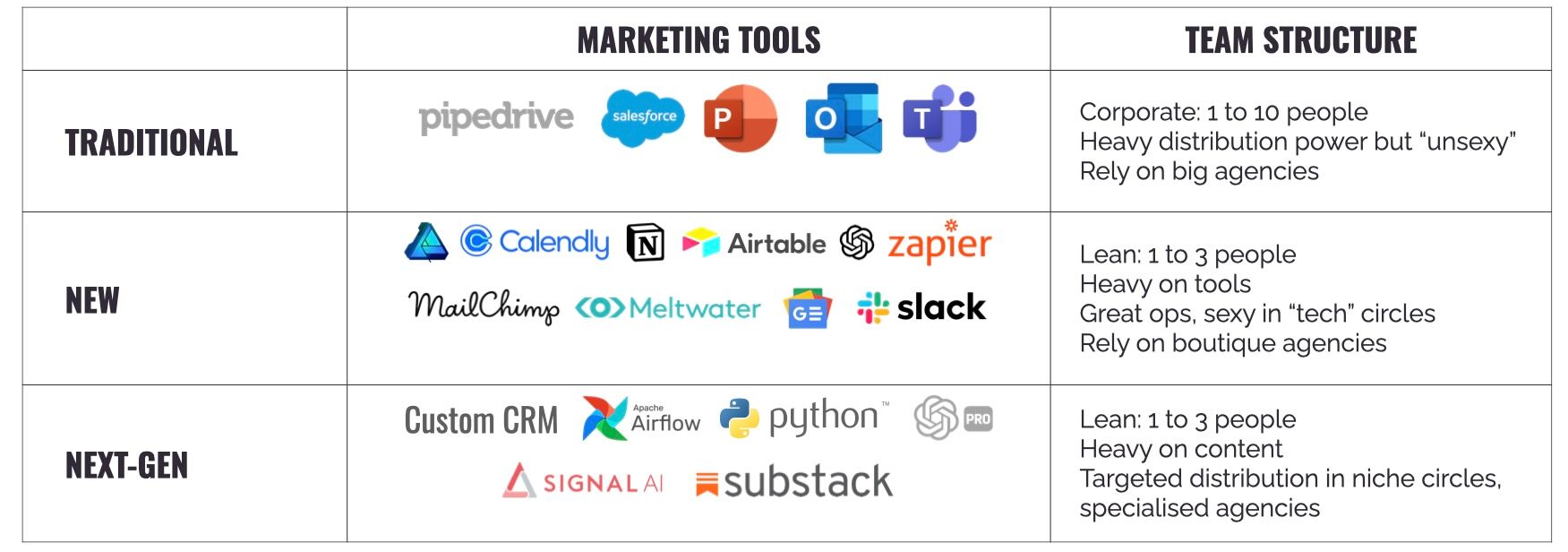

3) Structuring your tools and infrastructure

It’s tempting to get excited about sophisticated marketing tech but if you haven’t aligned your team around a guiding strategy, you’ll end up over-spending and under-delivering.

It's even more tempting to go straight into building your own platform infrastructure - after all your product is different from everyone else, and you have unique insights. Many companies have built their own dealflow management system or CRM but have really committed to product development. Salesforce is of course a more customisable tool than Edda or Affinity.

The best infrastructure supports real-world relationships rather than trying to replace them. Today many platforms are promising to automate anything and everything. Yet the most valuable infrastructure in a VC firm typically consists of a few essentials:

-

A core CRM or database

You need a place to track your deals, relationships, and pipeline. If you’re small, use whatever your team will consistently update - simple is fine. If you’re larger, you might integrate something more advanced with multiple data sources. Just ensure it’s user-friendly and can work without input (automatic enrichment) or no one will bother. -

Email and communication systems

Emails are the lifeblood of deal flow, LP updates, and day-to-day coordination. Whether you’re using a basic email platform or a fancy automation tool, set up processes so data isn’t lost or duplicated. For example, document important email threads in your CRM, or use consistent labels so you can find key communications later. -

Brand guidelines and shared resources

It’s helpful to have a central place with your logo files, core messaging statements, and basic design templates. This keeps everything on-brand and stops people from making “DIY” marketing materials that dilute your image. -

A knowledge base for the firm’s narrative

A simple Google Doc can store your main talking points, research highlights, and the story you want to tell. This doesn’t need to be fancy. However, if you keep it updated, you’ll avoid conflicting messages and you’ll save everyone from writing the same explanations over and over again. It can be the best prompt context ever for AI or copywriters. -

An editorial calendar

Even if you don’t operate a big content machine, a basic spreadsheet or shared calendar can help you plan which insights to publish and when. This ensures you’re not missing months of opportunity by waiting for a big news event to share.

4) Conferences, Events, and Deal Flow

Conferences can be a goldmine for sourcing deals, building relationships with co-investors, or boosting brand awareness, if approached strategically. They cab also a time sink and be prohibitively expensive if you’re not careful.

Used properly, conferences and events become a structured way to build momentum. You can harness these gatherings to gain market knowledge, deepen media ties, or funnel potential investments into your pipeline. The crucial thing is to keep them aligned with your overall objectives, so they become more than “just another trip.”

Here are a few guiding principles:

- Create a spokesperson matrix. Each individual have unique strike zones, play by people´s strengh and also how easy a pitch can be. the obvious one will be easier to lock in.

- Choose conferences wisely. Instead of sending half the team to every major conference, identify the ones that align with your sector focus or geographic strategy. Then, double down on those rather than chasing every opportunity. I recommend starting with 10 conferences a year to fully support from a marketing standpoint.

- Treat conference attendance like an asset. If you invest in tickets or sponsorship, treat it as more than a jolly. Afterwards, hold a quick debrief to share insights with the wider team on Slack or Notion. Encourage those who went to bring back real intelligence on emerging trends, new companies, or potential LP introductions.

- Quality over quantity. A large booth at a massive conference might seem prestigious, but it can be more valuable to cultivate a small dinner with high-value contacts. Don’t be dazzled by big names if the audience doesn’t really match your niche.

- Say no when needed. It’s tempting to appear everywhere, especially if you have an enthusiastic team. But avoid the trap of chasing events just because others do. If an event doesn’t tie back into your main strategy, skip it.

- Plan around lead generation. If the goal is to find deals or meet prospective LPs, be clear about it. Plan your outreach beforehand, set meetings in advance, and follow up quickly once the event is done.

5) LP communications

In many ways, clear LP communications can be your secret advantage. While some firms see it as a tedious requirement strong LP relations often lead to faster closes on the next fund, better referrals, and deeper long-term trust. Fiduciary duties are often overlooked by investors - surprisingly!

A few points I’ve found important over the years:

- Design and presentation matter. Quarterly reports don’t need to be works of art, but some consistent design and readable formatting go a long way. It’s frustrating for LPs when they receive locked PDFs that make it impossible to copy data or quickly compare numbers.

- Being timely and transparent. People often underestimate how valuable it is for an LP to receive updates on time. If there’s a development (positive or negative) share it promptly. Over the long run, honesty and clarity count for more than perfect performance.

- AGMs. Hosting a state-of-art AGM really strengthen relationships. If you’re an early-stage fund, these don’t have to be lavish. A concise, well-run gathering is more useful than an extravagant AGM.

- Legal and regulatory nuances. Familiarise yourself with the difference between formal “marketing” of a fund and “pre-marketing,” especially if you work across multiple European countries. Each jurisdiction can have unique requirements on how and when you approach prospective LPs and overlooking these will cost you thousands in legal fees and significant delays (especially considering the 18 months marketing deadline on marketing new funds)

6) Media & PR

Working with the press can be daunting for investors - and there are many reasons to that. Headlines are often reserved for big names or large fundraises, and journalists receive far more pitches than they can handle. At the same time, a well-placed article or interview can dramatically increase your chances of getting qualified dealflow into your inbox, especially if the media efforts are built on solid marketing foundations.

The ultimate objective is to build sustainable press strategies that reflect your broader vision. No single coverage piece will make or break you, but a pattern of being an insightful, credible voice will. If you treat journalists as partners in telling compelling stories (as opposed to purely transactional conduits for your news), you’ll find that it yields far better results over time. More importantly, journalists should be one of the stakeholders you naturally reach out to during due diligence - they are on the pulse of what's on the market and could be your secret weapon.

- Start with genuine relationships. You don’t want to reach out to a journalist only when you’re desperate to place a story, let alone if that's a story about your fund. Be in touch organically, share insights they might find interesting, or offer them expert commentary (as appropriate) without always expecting coverage.

- Focus on substance. Journalists often act like editors. If you have a strong opinion or unique data points, they’ll want to hear it. If your pitch is nothing more than “we exist,” it’s unlikely to cut through the noise.

- Align media opportunities with your narrative. If your firm has a specific thesis (say, industrial robotics or climate tech), make sure your media interactions reinforce your position as a knowledgeable commentator in that space.

- Avoid vanity coverage. There’s a difference between getting press that resonates with your target ecosystem and chasing headlines that don’t. If it doesn’t serve your long-term brand or speak to the right audience, it might not be worth the time and effort.

- Stay consistent. Even if a press piece doesn’t pan out, maintaining helpful contact keeps you in a journalist’s mental Rolodex. They might remember you when covering a future trend or asking for quotes.

If this resonates with you, EUVC has the full 2-hour masterclass available here.