The product-service company

Blending software efficiency (product) with implementation (service)

We spent two decades debating product-led versus service-led companies. For a long time, service companies couldn't claim fat margins of software companies. But AI has driven the marginal cost of outputs down so far that the software is cheap to build, and services are becoming really cheap to deliver.

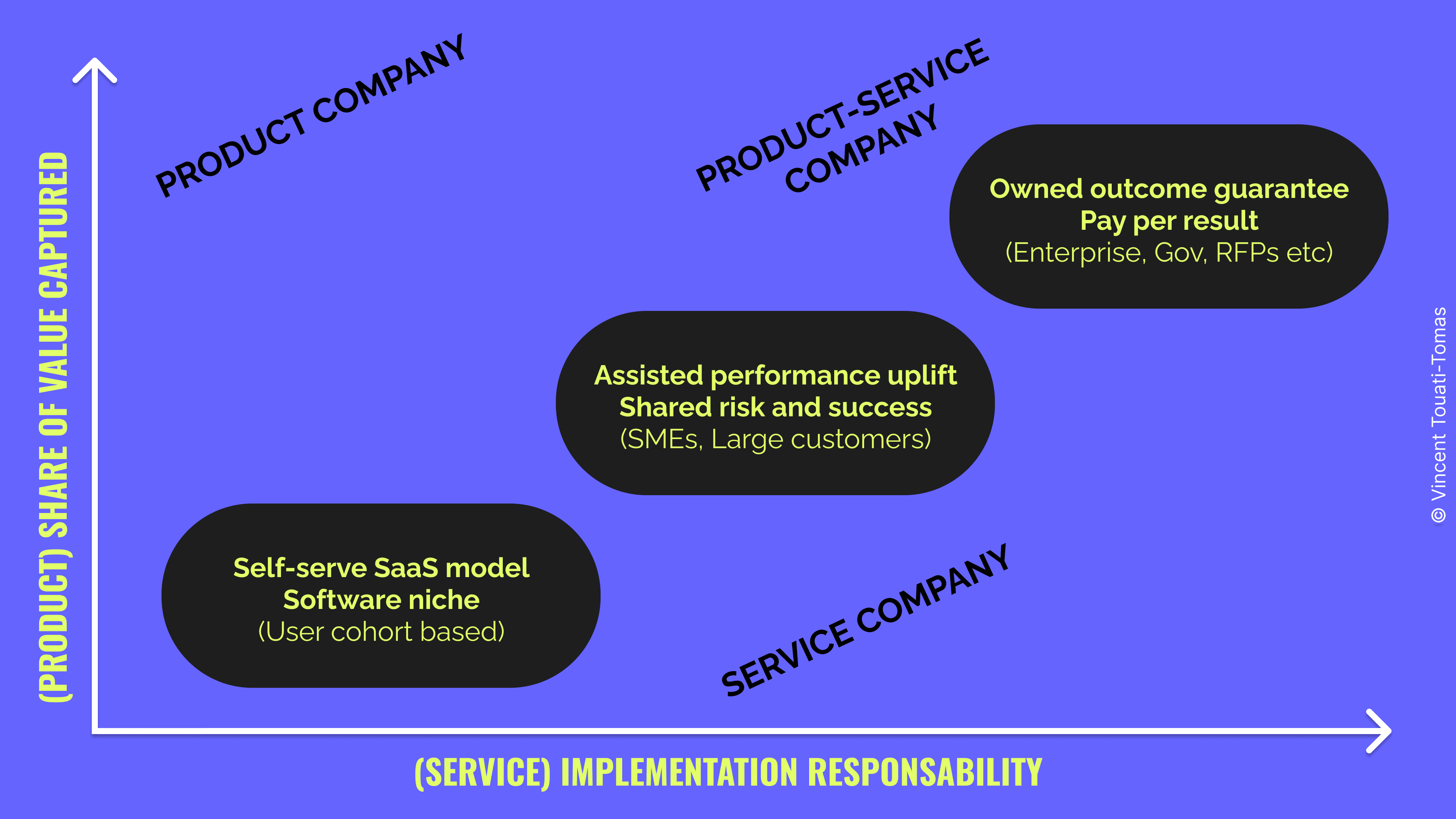

In this new world, the firms that win won’t be “software” firms or “services” firms, they’ll be product–service companies: a great product coupled with a great service, delivered as one bundle offer.

Salesforce’s partner economy shows how a product plus an implementation layer can outgrow the vendor itself. Palantir is essentially a consulting company for governments on tech adoption. OpenAI is leaning directly into AI implementation, making PwC the first global reseller for ChatGPT Enterprise and, by all accounts, building a consulting firm of its own.

When software marginal cost trends to 0, implementation becomes the defensible moat.

Companies don’t win by selling a tool into someone else’s process, they win by embedding inside the service itself, making delivery cheaper, faster and more accountable than incumbents.

Why now

Three things happened at once that changed how we operate companies.

1/ The cost curve flipped. AI is an industrial‑scale force multiplier for knowledge work. Every function, from research and comms to risk and ops, now has a long tail of tasks that are cheap, fast, and good‑enough to automate. McKinsey guesses the upside at $2.6–$4.4 trillion a year, concentrated in customer operations, marketing & sales, software and R&D.

2/ Distribution rebundled into ecosystems. Salesforce didn’t just sell CRM, it created a partner universe that earns >$6 for every $1 Salesforce earns. OpenAI's distribution machine is based on Microsoft channels and a mass-market product (ChatGPT) building brand premium, but the real bucks are made on enterprise integration and all things API. These are product–service flywheels.

3/ Markets bifurcated. Public returns went to a handful of megacaps and private fundraising is slower. If capital is still abundant (VCs are picker) differentiation isn’t. Buyers are now paying for results, rewarding whoever owns the last mile of implementation. It's not obvious ChatGPT is better than Claude on most use cases, yet their positioning allows for better integration.

What that means for the product-service firm

These companies think like a software company, but deliver like a boutique. The operating model is Service‑as‑a‑Software:

- Productised knowledge inside the firm: playbooks, templates, internal data, agentic workflows, so senior people spend time on judgement, not drafting.

- Human‑in‑the‑loop now, progressive autonomy later: because reliability and governance still matter. Protocols and processes exist for a reason.

- Outcome‑based pricing where it fits, because AI compresses the cost of goods sold.

- Ecosystem thinking from day one: partners for reach and implementation, thinking the ecosystem cashflow will outgrow you.

As the AI interface gets smarter, value flows to bundles that promise a finished job. AI gives everyone infinite interns but the adoption stalls unless someone owns the messy middle. That’s the job of a product–service company.

That shift needs measurement outcome‑linked pricing rather than the old SaaS model, and a different talent pyramid: fewer juniors grinding decks, more hybrid strategists who interrogate data, frame choices, and land decisions with potential customers. It's definitely not good news for young talent, because implementation is really hard and experience suddenly matter more than jumping on fancy new tools.

Instead of selling products, companies need to be the partner that explains X problem and prescribes the programme that fixes it, then uses AI to deliver faster than the old model could.

The last digital adoption cycle was software eats the world. This one is software and service eat the last mile. The firms that matter in this new era won’t argue definitions, they’ll own outcomes, and bundle products with expertise.

Price for results. Let the work, and the compounding, speak.